income tax withholding assistant for employers 2019

This Assistant implements the 2020 IRS Publication 15-T Federal Income Tax Withholding Methods. You may save a separate copy of this calculator for each employee to avoid having to re-enter the W-4.

How Do I Get My California Employer Account Number

945 Annual Return of Withheld Federal Income Tax.

. Amount of Federal income tax to withhold from this paycheck. Automate manual processes and eliminate human error with Sovos tax wihholding solutions. Complete if your company.

Booklet IL-700-T Illinois Withholding Income Tax Tables to calculate withholding. According to information on the IRS website. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to.

Enter the three items requested in the upper left. Complete Edit or Print Tax Forms Instantly. The Comptroller of Maryland is dedicated to helping businesses navigate and fulfill their tax and filing obligations.

2019 Employer Withholding Tax. If you have employees working at your business youll need to collect withholding taxes. Ad Payroll So Easy You Can Set It Up Run It Yourself.

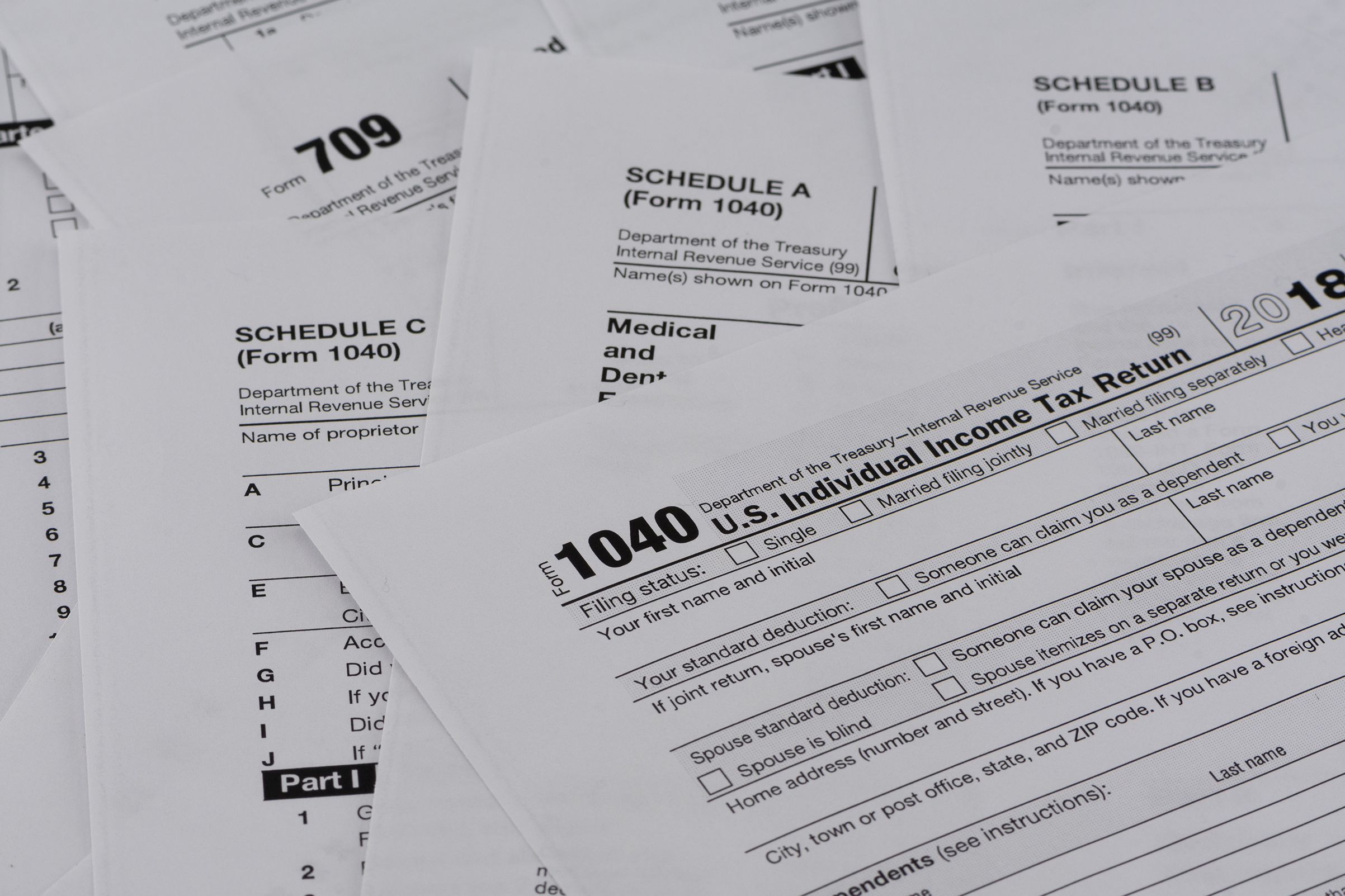

Withholding Income Tax From Your Social Security Benefits for more information. This section details the tax information for Corporate Pass-through and Sole. Information from the employees most recent Form W-4 if used a 2019 or.

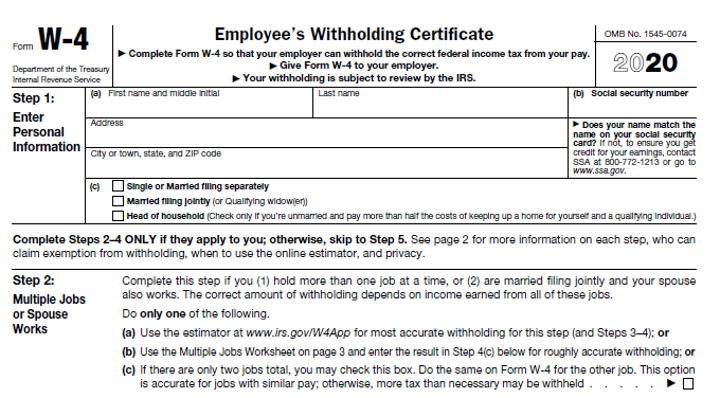

IR-2019-209 December 17 2019 WASHINGTON The Internal Revenue Service has launched a new online assistant designed to help employers especially small businesses. Income Tax Withholding Assistant for Employers For use with both 2020 and earlier Forms W-4 Pay frequency. 1042-T Annual Summary and.

All Services Backed by Tax Guarantee. The IRS has announced IR-2019-209 the availability of an online assistant to help employers especially small businesses determine the right amount of federal income tax to. Ad Complete Tax Forms Online or Print Official Tax Documents.

Income tax withholding assistant for employers 2019 Friday February 11 2022 Edit. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. Withhold no federal income tax if on the Form W-4 the employee claimed to be exempt from withholding.

View Other Tax Years. 2019 City Income Tax Withholding MonthlyQuarterly Return. This alert focuses on the following items.

The Internal Revenue Service has launched a new online assistant designed to help employers especially small businesses easily determine the right amount of federal income. Federal income tax to withhold from this paycheck is provided in the upper right corner. IR-2019-209 December 17 2019.

With that in mind the Internal Revenue Service IRS has. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. Publication 110 W-2 W-2c W-2G and 1099 Filing and Storage Requirements for Employers and Payers.

Ad Accurate withholding repotting to federal state and local agencies for all transactions. It is said death and taxes are for certain but you can definitely add the complexity of the tax system to that mix. These are state and county taxes that are withheld from your employees.

The IRS recently issued Notice 2018-92 providing interim guidance on various requirements and procedures for 2019 federal income tax withholding. Salary Lien Provision for Unpaid Income Taxes.

What Is A Tax Withholding Certificate Freedomtax Accounting Payroll Tax Services

Irs Overhauls Form W 4 For 2020 Employee Withholding

Irs Tool Helps Small Businesses Calculate Income Tax Withholding Small Business Trends

Business Taxes Employer Withholding

As New Withholding Looms Irs Launches Tool To Help Small Businesses Accounting Today

/the-concept-of-tax-settlement--912303164-28c2a4fb3bcf4656b57b44532247f9c6.jpg)

Irs Publication 15 Employer S Tax Guide

Federal Withholding Not Calculating

How To Fill Out A W 2 Tax Form For Employees Smartasset

The Percentage Withholding Method How It Works Paytime Payroll

How To Adjust Your Tax Withholdings Using The New W 4 Entertainment Partners

W 4 Calculator Free Irs W 4 Withholding Calculator 2021 2022 Turbotax Official

How To Calculate Federal Income Tax

Propublica Shows How Little The Wealthiest Pay In Taxes Policymakers Should Respond Accordingly Center On Budget And Policy Priorities

Irs Releases Tax Withholding Assistant For Employers Integrity Data

Why The Irs Should Pay People More In Their Tax Refunds Time